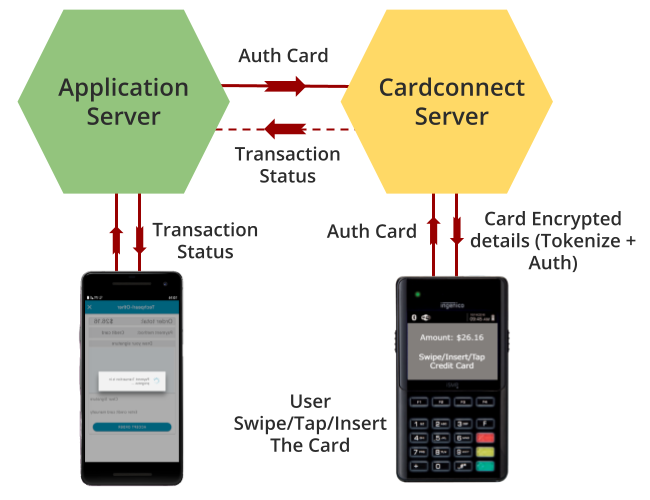

On the server using this session key and with the details of payment etc ‘authCard’ request is made.

https://developer.cardconnect.com/bolt-terminal#authCard

This prompts the insert/swipe/tap card message on the deviceUsers can swipe/tap/insert the credit card. This takes the confirmation for the amount. Card decline message is displayed in case of the card being declined.

Bolt terminal reads the credit card information and send it to cardconnect for tokenization

This API takes care of tokenization of the credit card, making the Authorization request call to cardconnect and returns the retrieval reference number to use in subsequent calls like Capture, Void,Refund.

On receiving the response, ‘disconnect’ call is made to disconnect the device, close the session and release the session key.

https://developer.cardconnect.com/bolt-terminal#disconnect