Breaking the API Mold: A new era of AI-Driven Customer Journeys

Breaking the API Mold: A new era of AI-Driven Customer Journeys

In the fast- paced world of financial services, speed, accuracy and scalability are critical. Yet, many lending institutions still rely on manual processes that slow down operations, increase errors and frustrate customers.

Our solutions in the Financial Services domain faced these exact challenges. While the customer had existing APIs for document analysis, their system lacked:

- Personalized Interactions with applicants.

- Contextual Understanding of customer behavior patterns.

- Cross- Data correlation between documents, website behavior and metadata.

The Solution: AI Agent - More Than just Document Analysis

We developed an AI Agent as a comprehensive solution that combines:

- Enhanced Document Processing

- Bank Statement, GST, Credit Bureau Analysis.

- Website Behavior Training

- Learning from user interaction patterns on customer portals

- Analysis of drop-off points in the application flows

Understood common customer queries and pain points

Technical Implementation: A Multi- Layered AI System

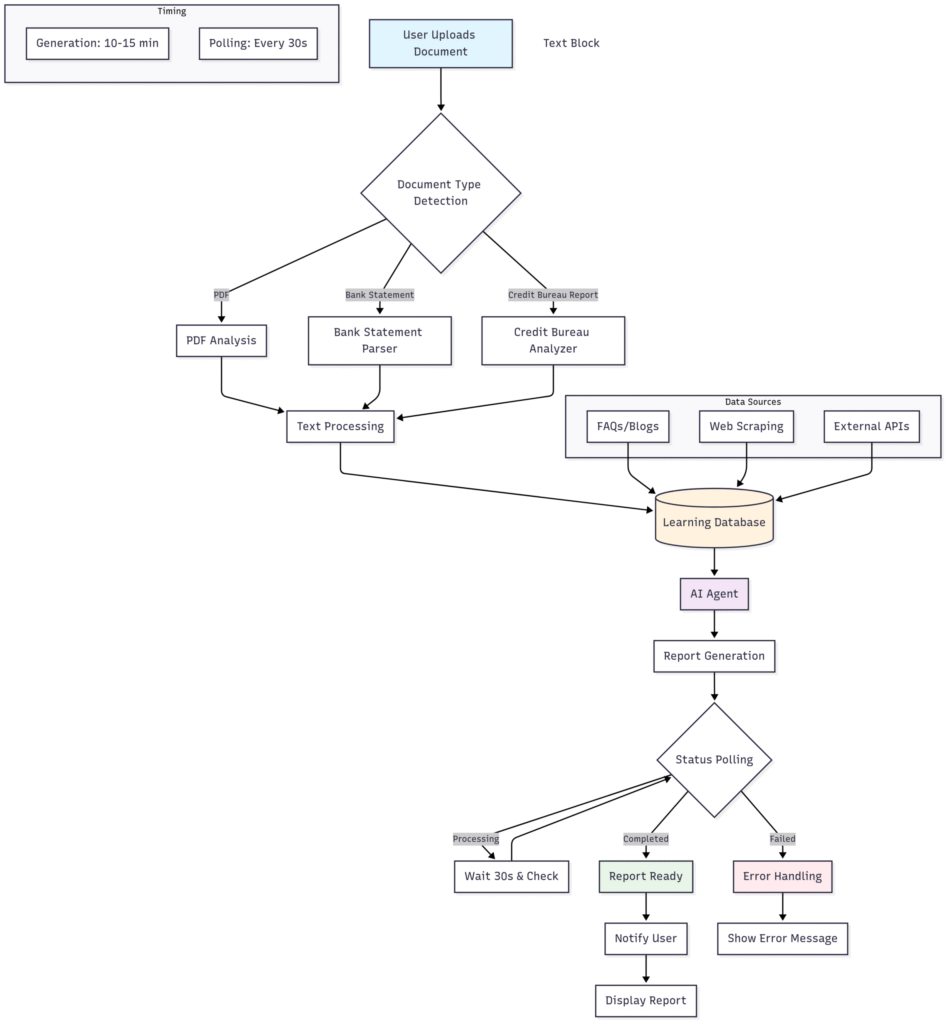

- User Uploads the Document

The journey begins when a user uploads a document to the platform. This could be:

- A bank statement

- A credit bureau report

- A generic PDF

- Document Type Detection

Our system automatically detects the type of document uploaded. Based on the classification, it routes the document to the appropriate parser or analysis engine:

- Bank Statements —–> Processed by the Bank Statement Analyzer.

- Credit Bureau Reports —–> Processed by the Credit Bureau Analyzer

- GST ——> Processed by the GST Analyzer.

- Text Extraction & Processing

Once the correct path is determined, the content is extracted using intelligent parsing and NLP techniques. This ensures even complex financial data is structured and ready for analysis.

- Continuous Learning from Rich Data Sources

To make smarter decisions and provide better insights, our agent taps into a variety of real-time and historical data sources:

- Internal FAQs and blog content

- Website scraping of relevant financial data

- Integration with external APIs (eg, for credit score, GSTIN validation etc)

This information feeds into a continuous learning database that improves the accuracy and relevance of every analysis.

- AI Agent Comes into Action

Our exclusive AI engine takes over at this stage, where it:

- Leverages the processed data

- Applies machine learning models and business rules

- Begins the core document analysis

This is where intelligence truly kicks in – understanding financial patterns.

- Document Analysis Begins

The backend workflow flags that analysis is underway. Depending on the document complexity, this stage can take anywhere between 10-15 minutes.

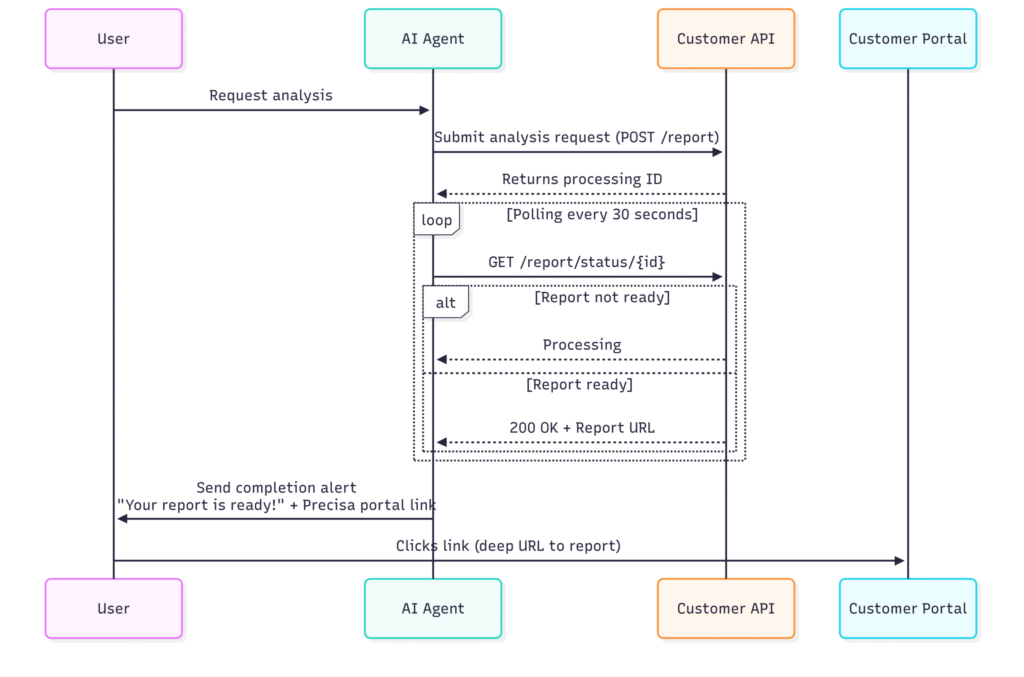

- Polling System Starts Monitoring

To keep the user experience seamless, our polling system checks for updates every 30 seconds:

- If the report is still being processed, the system waits and re-checks.

- If the report is successfully generated, a notification is sent to the frontend.

- If there’s an error, an appropriate error handling is triggered.

- Report Status Handling

Based on the analysis outcome, there are three possible results:

- Report Generated Successfully

- User receives a frontend notification

- A popup alerts them

- The report is now available to view

- Still processing

- The system waits and checks again without interrupting the user.

- Failed

- User gets an error message with possible resolution steps

Key Differentiators from Basic API Integration

Feature | Standard API Flow | AI Agent |

Document Analysis | Basic extraction | Context aware interpolation |

User Understanding | None | Website behavior patterns |

User Onboarding | Manual form filling | Chatbot guided onboarding with auto-document upload |

FAQ Resolution | Static help pages | Instant and conversational answers |

Conclusion

By combining document analysis with website behavior training and metadata integration, AI Agent delivers:

- Smarter decisions than rules-based systems

- More personalized automation than traditional automation and is more scalable than human underwriters