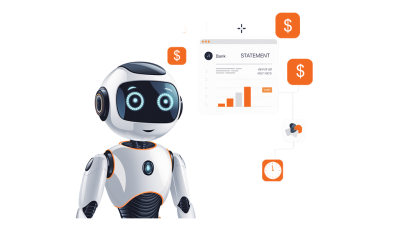

Accelerating Bank Statement Analysis with Pearlbot.ai

- Client: Precisa Financial Services

Category

HR Software Platform

Location

India

Engagement

Since 2023

Services

Full Stack App Development

01

Overview

Precisa aims to build a financial persona of an entity by analyzing its financial transactions—sourced from self-submitted electronic statements and consent-based access to public data. The company applies assessment frameworks such as gating and underwriting rules to help organizations serve their end customers more efficiently, intelligently, and quickly.

02

Business Challenge

Precisa Financial Services, a mid-sized lending institution, faced significant challenges with manual bank statement analysis. Loan officers typically spent 4–6 hours per application manually reviewing statements to identify income patterns, flag inconsistencies, and calculate financial ratios.

This manual process led to:

High Processing Time

An average of 5 business days per loan application

Elevated Error Rates

Approximately 12% of applications required rework

Customer Dissatisfaction

Increasing complaints due to delayed turnaround times

Scalability Constraints

Inability to efficiently manage peak season application volumes

03

The Pearlbot.ai Solution

To address these challenges, Precisa deployed Pearlbot.ai, an AI-driven chatbot tailored for financial document analysis.

The solution offered:

Natural Language Processing (NLP)

to intelligently extract key financial data from bank statements

Pattern Recognition Algorithms

to detect regular income sources and spending behaviors

Anomaly Detection

to flag inconsistencies and potential risks

Interactive Q&A Interface

enabling loan officers to query applicant financial data conversationally

Pearlbot.ai was seamlessly integrated into Precisa’s existing loan management system, ensuring minimal disruption to operations.

04

Results

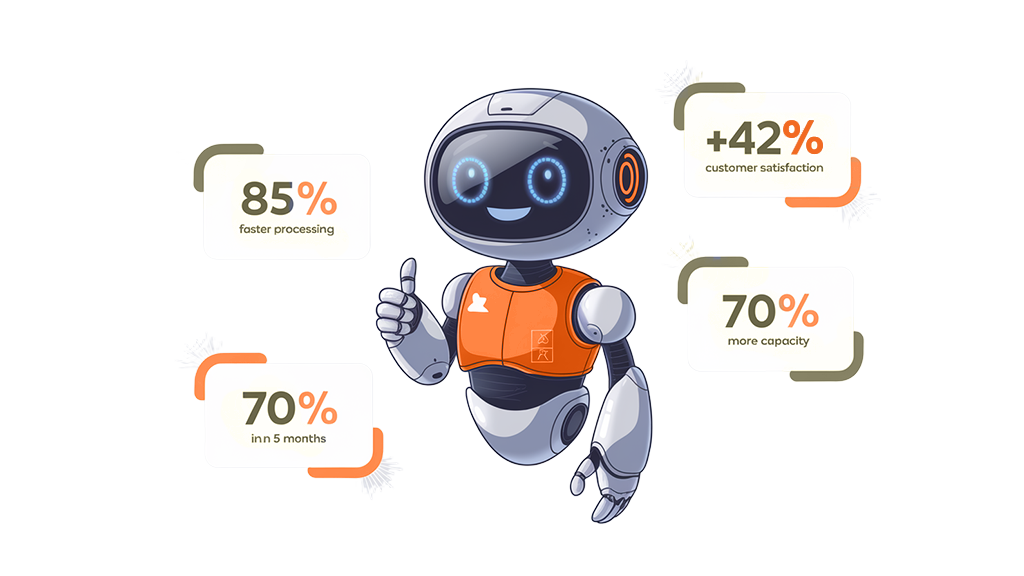

Within just three months of implementation, Precisa achieved outstanding results:

- 85% reduction in processing time (from 4–6 hours to 30–45 minutes per application)

- Error rates dropped from 12% to under 3%

- Customer satisfaction scores improved by 42%

- Loan processing capacity increased by 70% without additional staffing

- Return on Investment (ROI) realized within 5 months

05

Key Success Factors

Pearlbot.ai’s impact was driven by its ability to:

- Deliver conversational, context-aware responses to complex financial queries

- Standardize reporting, while intelligently highlighting cases needing human judgment

- Continuously improve accuracy through user feedback and machine learning

- Integrate seamlessly with existing operational systems, ensuring smooth adoption

06

Conclusion

This case highlights how a specialized AI chatbot like Pearlbot.ai can revolutionize traditionally manual, resource-heavy financial workflows. By enhancing efficiency, reducing errors, and improving customer satisfaction, AI-enabled automation unlocked substantial business value for Precisa Financial Services.

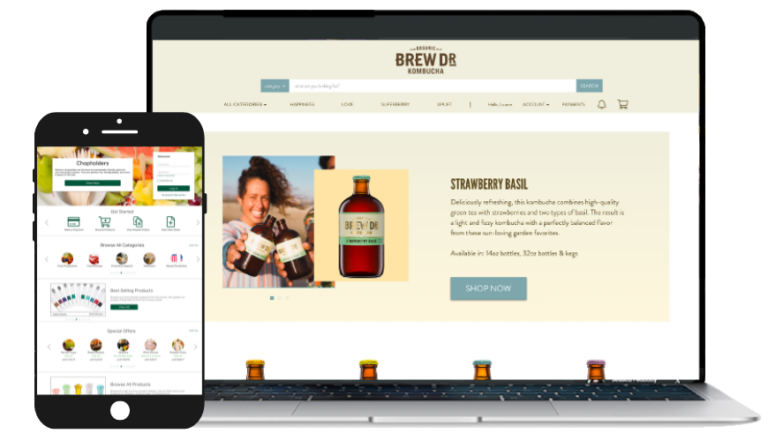

SWAE is an all-in-one decision making and governance tool empowering the next generation of Web3 DAO(Decentralized Autonomous Organization) communities. Techpearl continues to work as the technology partner to Swae since 2017 and handles the end to end product development covering deployment of engineering processes & tools. AWS serverless architecture was adopted to provide a cost effective solution.

SEMBA provides an enterprise level B2B digital cloud commerce platform. It provides an Amazon-like experience with AI, Analytics, B2B Processes and supply chain solutions for wholesalers, distributors, manufacturers, retailers and franchises. Customizable order and invoice management, multiple payment gateway support, Built in ERP integration makes Semba a very powerful platform that enables quick go to market for existing businesses.